cash flow from assets equals

Need an alternative to traditional business loans or lines of credit. - equals net income plus non-cash items.

Understanding Closely Held Company Cash Flow Sliwoski 2018 Journal Of Corporate Accounting Amp Finance Wiley Online Library

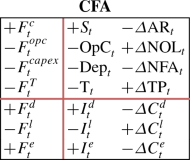

Cash flow from Assets Cash Flow from Operations - Capital Spending - Additions to Net Working Capital.

. Cash flow from assets is the aggregate of sum of all cash flows relating to the assets of a business. Cash flow from assets A equals net income plus non cash items B can be positive from CIS FIN103 at Prince Sultan University. This results in the following cash flow from assets calculation.

W Changes in net working capital. Cash flow from assets equals. Operating Cash Flow- Net Capital Spending- Change in Net Working Capital Operating Cash Flow.

Ad QuickBooks Financial Software. It can be computed as. Cash flow from assets Cash flow from operations - Change.

The cash flow identity states that cash flow from assets equals cash flows to ____. The cash flow to shareholders minus the cash flow to creditors. O The same as the Net Working Capital cash flow to creditors cash flow to stockholders cash flow to creditors - cash flow to stockholders cash flow to.

We are paid a fixed amount of cash each year regardless of how much we have in cash flow or how much we have in other. Ad Leverage your accounts receivables other business assets to boost your cash flow. Ad Leverage your accounts receivables other business assets to boost your cash flow.

For example if we have an unexpected windfall and dont plan on spending it on a house we can take it out of the bank and invest it in an asset. O The same as the Net Working Capital O cash flow to creditors cash flow to stockholders O cash flow to creditors - cash flow to stockholders cash flow to. - equals operating cash flow minus net capital spending.

Rated the 1 Accounting Solution. Equity investors and the government d. Need an alternative to traditional business loans or lines of credit.

Creditors and bondholders b. - equals the addition to. We then get a certain return on.

Cash flow from assets. 12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in. Equation for calculate cash flow from assets is Cash Flow From Assets f - n - w Where f Operating cash flow.

Operating cash flow plus the cash flow to creditors plus the cash flow to. Cash flow from assets equals. It determines how much cash a business uses for its operations with a specific period of time.

Cash Flow From Assets. N Net capitalspending. Cash Flow from Assets SHOULD BE Cash Flow to Stockholders Cash flow to Creditors.

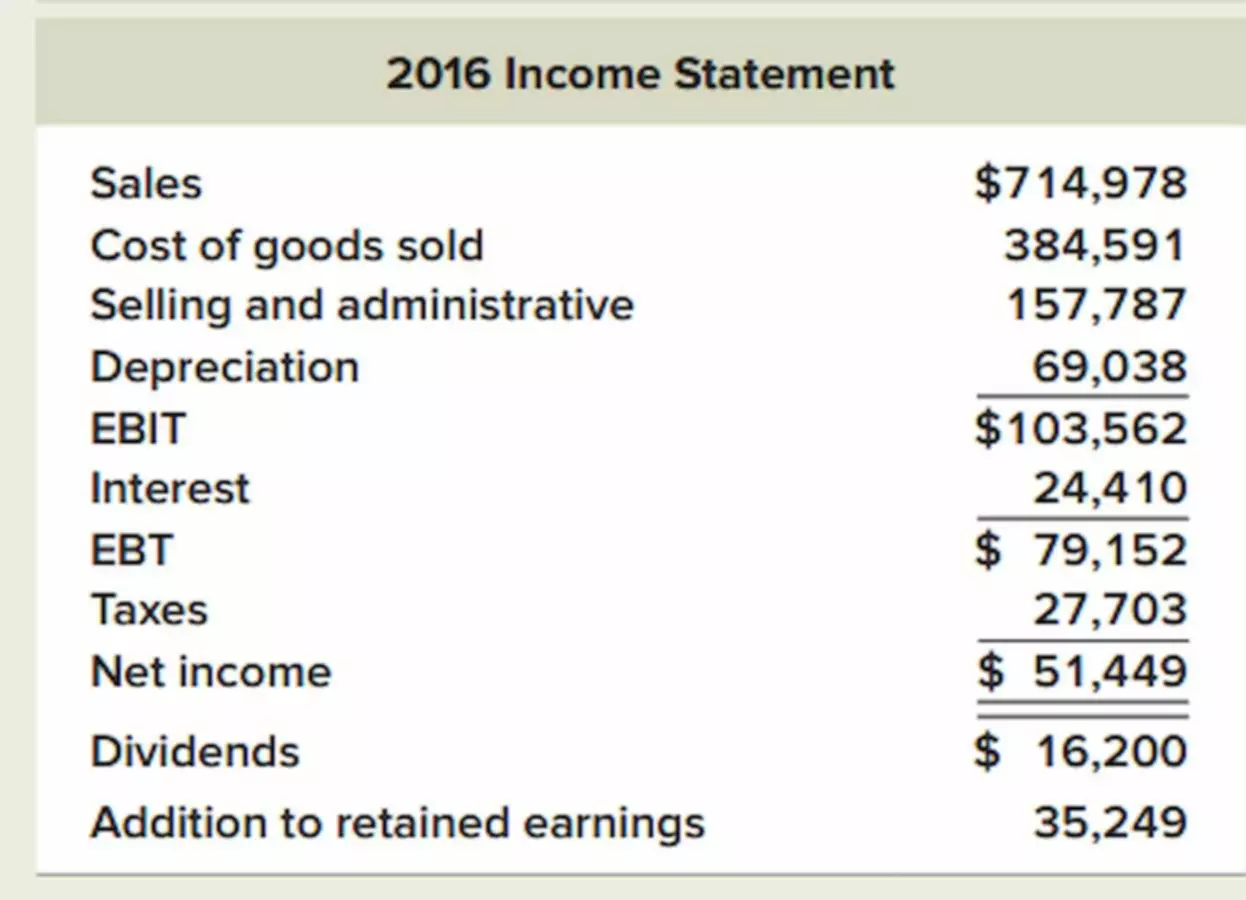

- can be positive negative or equal to zero. EBITdepreciation - taxes Net Capital Spending. This is the first step of the income tax equation.

However cash flow to stockholders would be replaced by cash flow. A business will run into serious problems if its operating cash flow is negative. Creditors and stockholders c.

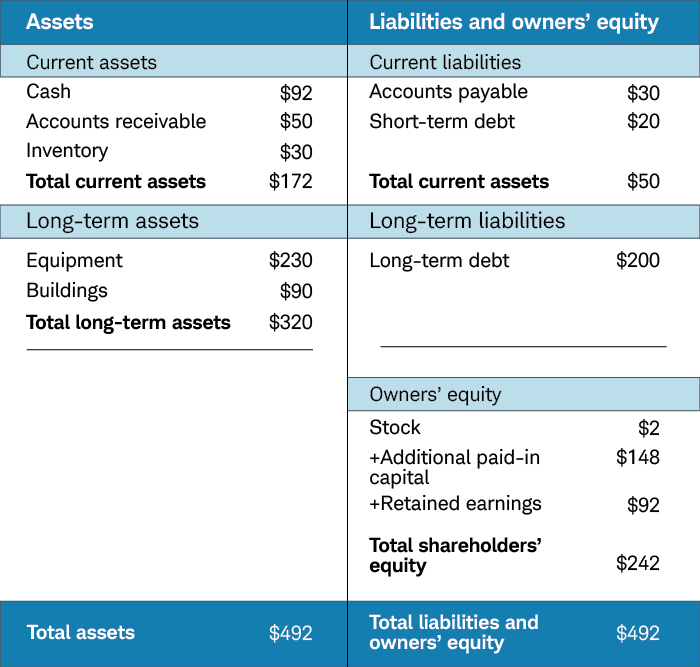

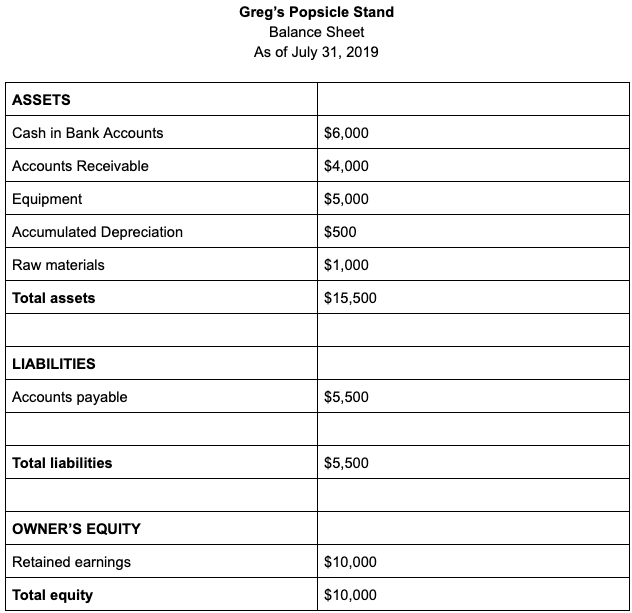

Cash flow from assets refers to a businesss total cash from all of its assets. Assets Liability Equity then. Cash flow from assets is defined as.

3 Financial Statements To Measure A Company S Strength Charles Schwab

Assignment 1 Chapter 3 Part 1 Pdf Revenue Balance Sheet

Chapter 2 Financial Statements Taxes And Cash Flow Flashcards Quizlet

Cash Flow From Assets Definition And Formula Bookstime

Cash Flow From Assets Using Excel Youtube

Cash Flow Statement Explanation And Example Bench Accounting

Cash Flow To Assets Desjardins Online Brokerage

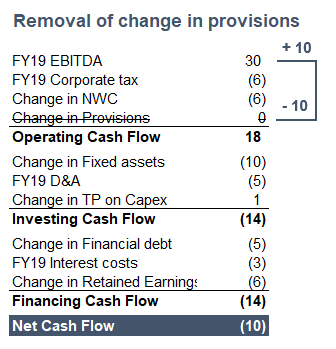

Net Cash Flow Business Finance Solved Exam Exams Business Finance Docsity

Definitions Of Variables Cf Cash Flow Equals Net Profits Plus Download Table

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

What Is Cash Flow And Why Is It Important For Small Businesses

How To Use Cash Flows Help Center Financial Planning Software Rightcapital

How To Find And Calculate Changes In Working Capital For Owner S Earnings

Cash Flow Statement Financial Edge

:max_bytes(150000):strip_icc()/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

5 2 Impairment Of Long Lived Assets To Be Held And Used

Understanding Your Numbers Part 3

Estimating The Cash Flows Springerlink

How To Prepare A Cash Flow Statement Model That Balances Toptal