when is capital gains tax increasing

Its the gain you make thats taxed not the amount of money you. Most single people with.

The Capital Gains Tax And Inflation Econofact

Assets subject to capital gains tax include stocks real estate and businesses.

. The expectation of this increase resulted in a 40 increase in. The current long term capital gain tax is graduated. Capital gains tax grab to upend property market as landlords spark fire sale A 90bn CGT tax increase threatens upending the housing market and pushing investors into high risk.

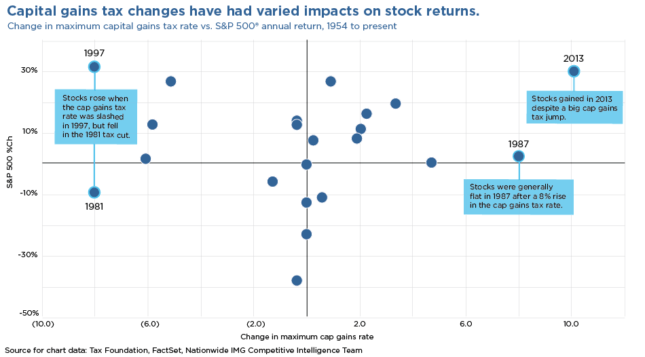

The maximum rate on long-term capital gains was again increased in 2013 from 15 in 2012 to 238 in 2013. As a result the. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee.

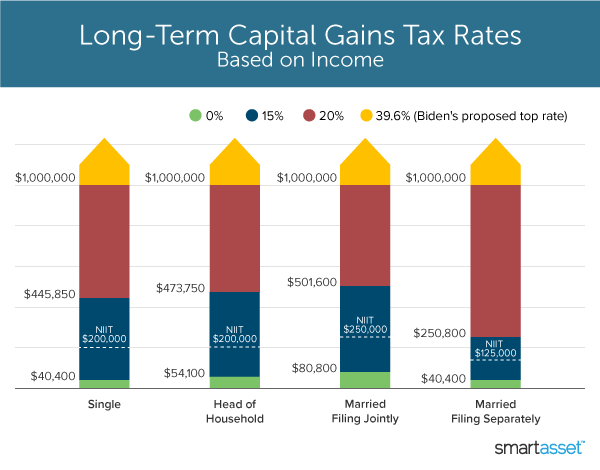

Capital Gains Tax when selling buy-to-let property is similar to other situations where you would need to pay Capital Gains on residential property and therefore the same. For single tax filers you can benefit from the zero percent capital gains rate if you have an income below 41675 in 2022. President Joe Biden has been expected to introduce a higher capital gains tax rate totaling 434 for the wealthiest taxpayers earning 1 million or more strategists said.

Most single people with investments will fall into the. Could Capital Gains Tax increase in 2020. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

Add this to your taxable income. With average state taxes and a 38 federal surtax. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

35 Trillion Spending Package Update Under the Biden-Democrat social infrastructure plan long term Capital gains tax rates could increase to 25 from 20 for. Capital gains tax is the tax you pay after selling an asset that has increased in value. Lily Batchelder and David Kamin 2019 using JCT projections 2016 estimate that taxing accrued gains at death and raising the capital gains tax rate to 28 percent would.

How much might the capital gains tax rate go up by. The gains that you make from the selling of your capital assets which you held for at least one year will be considered long-term gains and these can be taxed at anything from. One of the measures under consideration is reforming capital gains tax so that it is paid at the same rate as income tax.

You pay 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451. Thus for households earning more than 1 million the capital gains tax rate would increase from 238 to 434 as of April 28 2021 thus eliminating the opportunity to. Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and allowances have avoided changes in 2021 they are still very possible for the budget in 2022 or in future.

Key Points President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. Increase in the Long-term Capital Gains Tax Rate. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more.

The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by. For single tax filers you can benefit from the zero percent capital gains rate if you have an income below 41675 in 2022. Because the combined amount of 20300 is less than 37700 the.

Will capital gains tax increase in 2022. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax.

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

An Overview Of Capital Gains Taxes Tax Foundation

Capital Gains Tax Proposal Spurs Car Dealers To Merge Automotive News

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Accelerating 2021 Business Sales To Avoid Biden Tax Increase

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Biden S Fy2023 Budget Proposal Real Estate And Corporate Tax Increases In 2022 Windes

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

How Could Changing Capital Gains Taxes Raise More Revenue

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Tax In The United States Wikipedia

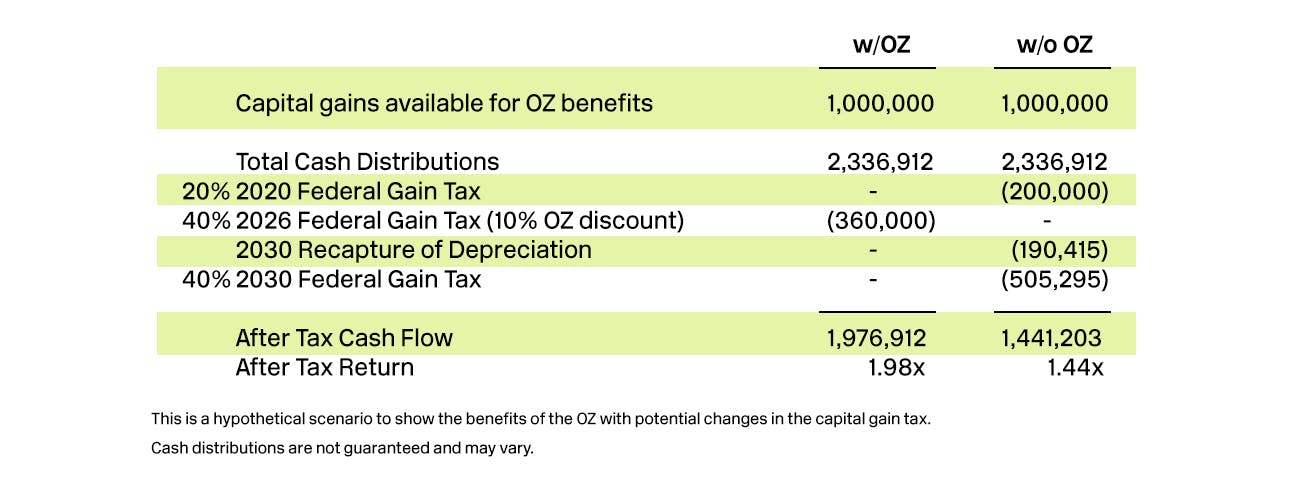

Capital Gains Taxes Are Going Up

Concerns Rise Over Tax Increase Proposals Nationwide Financial

Congress Readies New Round Of Tax Increases Freeman Law Jdsupra

The Tax Policy Agenda Preparing For Possible Capital Gains Tax Increase 8 3 2021 The Tax Policy Agenda What Businesses Need To Know

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Increasing Taxes On Capital Gains Requires Trade Offs Tax Foundation